Michael Jordan became the first professional athlete to enter the list of 400 richest people in America with a net worth of $3 billion.

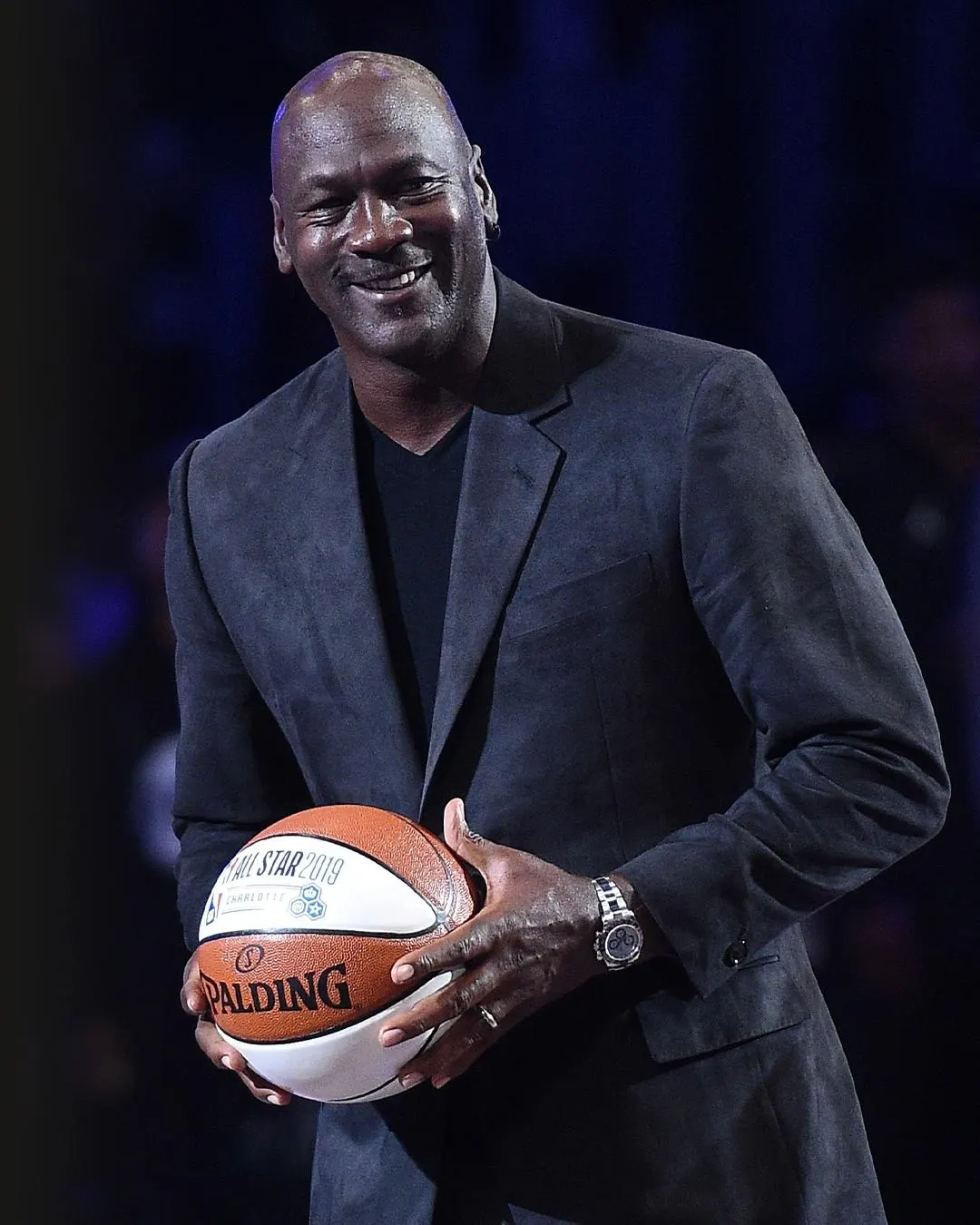

“Michael Jordan is one of the rare names to succeed three times,” Ted Leonsis. Photo: Kevork Djansezian/Getty Images.

Debuting in the American Professional Basketball League (NBA) in 1984, Michael Jordan has become an outstanding name in both competition and income. 15 seasons of “fighting” on the NBA playground brought Jordan an income of 94 million USD and he became the highest paid athlete in the tournament twice in a row in 1997 and 1998.

But it is his off-the-field income that shows the huge gap between Michael Jordan and other athletes around the world, when he “pocketed” $2.4 billion in pre-tax income and expenses for his career. representative throughout his career from contracts with brands such as McDonald’s, Gatorade, Hanes. Especially Nike, the sports brand that recently helped Jordan earn about 260 million USD in image royalties.

Michael Jordan made his biggest “winning shot” in August 2023, when he sold a controlling stake in the Charlotte Hornets basketball team in a deal worth $3 billion. Even when applying a valuation of 1.7 billion USD according to Forbes statistics in 2022 to sell the team, this is still a successful business deal for this 60-year-old legend. The sale of the NBA’s 27th most valuable basketball team marks the second largest sale in league history, a 17-fold increase compared to when Jordan became the owner of the Charlotte Hornets.

The above deal increased Michael Jordan’s total net worth to $3 billion, helping him become the first professional athlete to enter Forbes’ list of the 400 richest people in America (Forbes 400).

“Michael Jordan is one of the rare names who succeeded three times. A lot of entrepreneurs only succeed once, then they retire or try something a second time and it doesn’t work,” said Ted Leonsis, owner of the Washington Wizards (Men) and Washington Mystics (Women) basketball teams. ), next to an oil football team, the Washington Capitals, commented on Michael Jordan, with whom he has cooperated many times in investing in sports. Leonsis mentioned Jordan’s influence as an athlete, owner and developer of the Air Jordan sneaker brand with Nike.

A professional athlete becoming a billionaire is still rare in the sports world, with only three names doing this. Michael Jordan was the first person to achieve the billionaire title in 2014. Followed by LeBron James and Tiger Woods. LeBron James and Tiger Woods own billions of dollars in assets while still playing.

The first pair of Air Jordans debuted in 1985. In 2022, the shoes were auctioned by Sotheby’s and fetched $560,000. Photo: Focus on Sport/Contributor/Getty Images.

As current incomes increase and more development opportunities appear outside of competition, the sports industry will have more athletes becoming billionaires in the future. According to Forbes estimates, the sports field currently has seven athletes recording pre-tax income and agent expenses near the $1 billion threshold.

However, becoming a billionaire requires many different factors or as Mark Cuban, owner of the Dallas Mavericks basketball team, said, “athletes need a lot of luck.” But Michael Jordan’s path to becoming a billionaire has been laid out since he started playing in the NBA.

When Air Jordan first launched in 1985, a year after Michael Jordan’s first NBA season, this shoe brand then helped Nike earn 3 million. Two months later, Air Jordan sales reached 70 million USD and increased to 100 million USD by the end of 1985, according to Temple University research in 2023. Initially, Michael Jordan signed a 5-year contract with Nike, Earning 500,000 USD/year in image copyright fees. In Nike’s latest annual business report, the sports company reported a 28.6% increase in annual sales revenue to $6.6 billion compared to 2022.

But Nike is not the only company that sees business opportunities from taking advantage of the talent and charisma of the name Michael Jordan. “He was already a brand himself before the concept of personal branding became popular. It’s not that Michael Jordan is promoting Gatorade, but the company has adopted the marketing approach of ‘Drink Gatorade to be like Michael,'” said Marc Ganis, president of consulting firm Sportscorp. .

Just a short time after his second retirement in 1998, Michael Jordan switched from playing to investing and operating a professional basketball team. According to ESPN, Jordan was unsuccessful in buying the two basketball teams New Orleans Pelicans (now renamed New Orleans Pelicans) and Milwaukee Bucks.

Ultimately, Jordan joined a group of investors led by Ted Leonsis to buy the Washington Capitals football team, as well as a 44% stake in the Washington Wizards basketball team. At the Washington Wizards, Jordan serves as executive chairman. At the time, Abe Pollin held the most shares in Wizards.

“He was a quick learner, a quick learner, and asked a lot of questions,” Ted Leonsis recalled of Michael Jordan. Leonsis said he shared with Jordan about the business aspect of sports. “He has a more successful approach and believes that selling tickets and attracting sponsorship is easier if you have a good squad with star players,” Leonsis said.

In 2000, Michael Jordan became a minority shareholder of the Washington Wizards basketball team and served as executive chairman. Photo: Doug Pensinger/Staff/Getty Images.

Some time later, Michael Jordan sold shares in the sports teams he invested in because he decided to return to professional competition for two seasons. In 2003, Jordan announced his final retirement and quickly bought another basketball team. In 2006, Jordan purchased a minority stake in the Charlotte Hornets. In 2010, he became the first former player to own more than 50% of shares in an NBA basketball team.

Most of the capital that Michael Jordan used to invest in Charlotte Bobcats was a loan and valued this team at $175 million. This figure is significantly lower than the $300 investment that Robert L. Johnson, founder of Black Entertainment Television (BET), spent to own the Charlotte Hornets in 2003.

Michael Jordan is an extremely competitive person, but the Charlotte Hornets have not had good results on the football field, being eliminated from the NBA Playoffs series in the first round three times in the past 13 years. Even though the Charlotte Hornets had poor results, Jordan still benefited from the increased value of this basketball team.

In 2019, Jordan sold 20% of the Charlotte Hornets to Melvin Capital founder Gabe Plotkin and D1 Capital Partners founder Daniel Sundheim for $1.5 billion. The team’s valuation later doubled when Michael Jordan sold a controlling stake to Plotkin and Rick Schnall, another hedge fund founder.

“This deal has led to the owners having to revalue their team. If the Charlotte Hornets were sold at that price, my team (with its larger size and higher revenue) would be worth even more. He made a deal that benefited the owners of other teams. The value of the teams could have dropped if Jordan wanted to quickly sell his shares in the Charlotte Hornets at a low price,” Leonsis said.

Michael Jordan still holds a minority stake in the Charlotte Hornets. This helps Jordan stay connected to basketball and allows him to seek out new business opportunities. Over the years, Jordan has poured capital into other areas including car trading, restaurants and most recently equity investments. Through Ted Leonsis, Jordan bought shares in CLEAR, Mythical Games, Dapper Labs, DraftKings, Sportradar and others.

Ted Leonsis believes Michael Jordan’s next challenge will be participating in NASCAR racing. In 2020, Jordan and Denny Hamlin, driver of Joe Gibbs Racing, co-founded a racing team called 23XL Racing that competes in NASCAR. “The investment in NASCAR could become Michael’s next successful business. This comes from his competitiveness and desire to win,” Leonsis said.

News

DRAYMOND GREEN TRASHES PATRICK BEVERLEY’S ANTICS .kf

Draymond James is not holding back on his opinions about Patrick Beverly’s post-game actions. In a recent statement, James expressed concern over Beverly’s behavior following losses. The…

LEBRON JAMES ‘SHUDDERS’ AT DARVIN HAM’S PLANS FOR HIM: “IT’S LIKE TRYING TO FIT A SQUARE PEG INTO A ROUND HOLE” .kf

LeBron James ‘bristled’ at Darvin Ham’s scheme for him, and the Lakers swiftly ditched it. The plot twist had everyone scratching their heads. Imagine King James getting…

Wild New Rumor Claims LeBron James To The Philadelphia 76ers Is “Going To Happen” .kf

LeBron James (Photo by Ronald Martinez/Getty Images) For what seems like the third or fourth time in his illustrious career, we are trying to figure out where LeBron…

Everyone Is Falling In Love With NBA Reporter Ashley ShahAhmadi During The Playoffs .kf

Ashley ShahAhmadi (Photo via ashleynshahahmadi/Instagram) Ashley ShahAhmadi, the Charlotte Hornets reporter, is going extremely viral on social media. A recent stir among NBA fans was sparked when they discovered a new…

VIDEO: Some Dude Just Revealed the Cold Cold Truth About Why All These NBA Draft Prospects Are “Dating White Women” .kf

Caleb Williams at NFL Draft (Photo by Aaron J. Thornton/Getty Images) Unless this is your first day in America, then you know race relations in this country…

Denver Nuggets star Michael Porter Jr. gifted dad a Tesla for Christmas and surprised mom with SUV in his rookie year .kf

DENVER Nuggets star Michael Porter Jr. hasn’t been afraid to give back to his parents who helped him reach the NBA. Porter Jr. gifted cars to his…

End of content

No more pages to load