New Report Drops Giant Truth Bomb On Rumors That Michael Jordan Is Selling Hornets Because He’s Going Broke

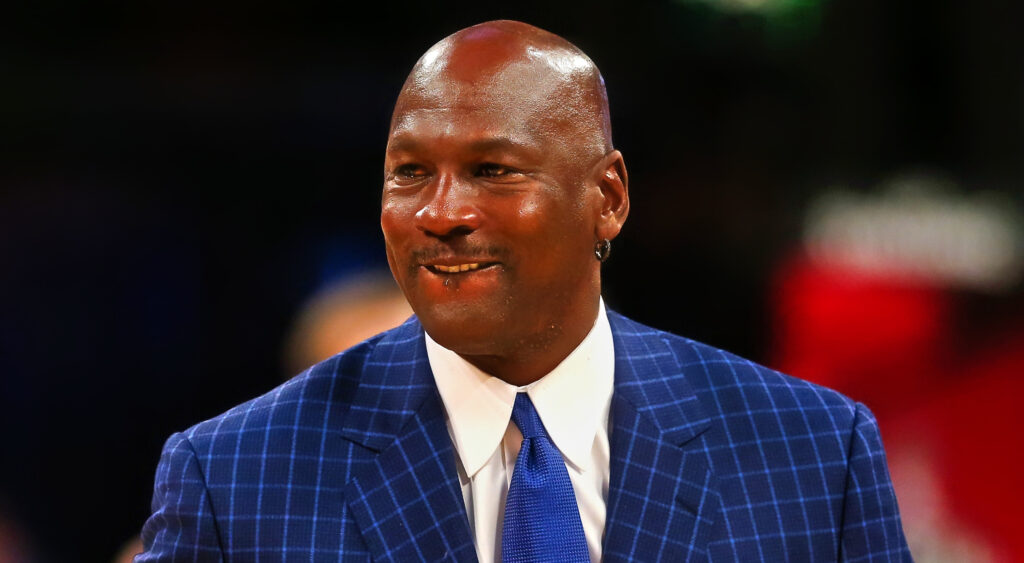

TORONTO, ON – FEBRUARY 14: NBA hall of famer and Charlotte Hornets owner Michael Jordan walks off the court during the NBA All-Star Game 2016 at the Air Canada Centre on February 14, 2016 in Toronto, Ontario.

TORONTO, ON – FEBRUARY 14: NBA hall of famer and Charlotte Hornets owner Michael Jordan walks off the court during the NBA All-Star Game 2016 at the Air Canada Centre on February 14, 2016 in Toronto, Ontario.

Michael Jordan is set for an enviable payday as he’s finalizing a deal that will see him relinquish ownership of the Charlotte Hornets.

The former Chicago Bulls superstar is selling his majority stake in the team for a reported $3 billion, with minority owners Gabe Plotkin and Rick Schnall set to take over.

There are now widespread rumors claiming that the GOAT is broke as a result of the losses he made on the ill-advised Gamestop short move but, according to sports business journalist Joe Pompliano, they are unfounded.

Pompliano also points out that no one would ever lose the sum being thrown about on a single short position in the market.:focal(3078.5x2062:3088.5x2052)/cloudfront-eu-central-1.images.arcpublishing.com/ipmgroup/HE7OLORF7FDJDNE7FVTVFF64NI.jpg)

“The numbers make no sense, and it’s pure speculation based on Forbes lowering his net worth by $500M during the pandemic,” the journo wrote in response to a thread explaining how MJ is selling the team because he lost it all.

“There are no reputable sources, and no one would ever lose that much on a single short position lol.”

Last week, Pompliano explained how His Airness is about to make $3 billion after only forking out $25 million when he purchased the majority share in the team.

Previous owner Robert Johnson agreed to sell the franchise to Jordan at a discounted $275 million but the latter only had to put $25 million down in cash on a $170 million equity evaluation as the remaining $105 million was mostly made up of business debt.

News

PHOTO: Hanna Cavinder, worth $924,000 NIL, wears an all-denim ensemble at the Miami Grand Prix in 2024. tt

PHOTO: $924,000 NIL-valued Hanna Cavinder show off an all-denim outfit for Miami Grand Prix 2024 Hanna and Haley Cavinder attended Miami Grand Prix 2024. Hanna Cavinder and…

Luka Doncic’s mother during the Mavericks-Clippers playoff game caught everyone’s attention with her exquisite ensemble. tt

Luka Doncic’s Mom Was Turning Heads With Her Stunning Outfit At Mavericks-Clippers Playoff Game Luka Doncic mother (Photo via Mirjam Poterbin/Instagram) Luka Doncic’s parents, Mirjam Poterbin and…

In an explosive Netflix documentary, Tim Donaghy exposed Michael Jordan, Phil Jackson, and the NBA (VIDEO) tt

Tim Donaghy Exposed The NBA, Phil Jackson, & Michael Jordan During Explosive Netflix Documentary (VIDEO) The name Tim Donaghy will forever be connected to the NBA as some fans…

During a rant, Kanye West shockingly claims that Michael Jordan’s father was “sacrificed” to the Illuminati (VIDEO) tt

Kanye West Makes Shocking Claim That Michael Jordan’s Dad Was ‘Sacrificed’ To The Illuminati During Rant (VIDEO) Kanye West has lost a lot of deals and a ton…

Details Of Michael Jordan’s Prenuptial Agreement With Current Wife Yvette Prietto Are Revealed in a New Report. tt

New Report Uncovers The Details Of Michael Jordan’s Prenup With Current Wife Yvette Prietto After going through a massive divorce in the past, NBA Great Michael Jordan apparently has a prenup…

“I Feel Bad for Michael”: Charles Barkley Gives His Take on Marcus Jordan’s Messy Affair With Larsa Pippen. tt

“I Feel Bad for Michael”: Charles Barkley Gives His Take on Marcus Jordan’s Messy Affair With Larsa Pippen Charles Barkley, Michael Jordan, Larsa Pippen and Marcus Jordan…

End of content

No more pages to load